Commentary — Rob McKinley

With so much focus on funding in the recently tabled Alberta 2021 Budget, dollar figures and calculations obviously play a large part. Big changes in how provincial funds come to municipalities from the City of Edmonton to the Summer Village of Pelican Narrows or the Buffalo Lake Metis Settlement will be coming in the next few years. As the long-serving Municipal Sustainability Initiative fades away, the province is rolling out the Local Government Fiscal Framework Act. The act comes with new rules, new figures, but unfortunately, no calculus instructor or scientific calculator to figure it out.

Funding formulas, it seems, are apparently not as simple as "how much do we have" divided by "how much do you need".

An unintended deep dive — more of an accidental tumbling free-fall down a Google-searched rabbit hole — into the new fiscal framework to determine how future grant funding will be set for the province's municipalities, turned into the worst math class in history. Remember commutative algebraic equations? This stuff is worse ... and it's going to determine how we get money for community hall renovations and new bike trails.

Now admittedly, like an Indiana Jones adventure where one golden amulet may be the literal and figurative key to a wealth beyond imagination ... and beyond that sketchy limestone wall carving ... knowing the province's Revenue Index Factor is an integral part of the formula. The Revenue Index Factor is like dusting off that abracadabra nugget ... and then simply multiplying revenues from previous years with available capital funding ... and "tah-dah", you have unearthed the long-hidden treasure (or in this case, the amount of your own tax dollars the province is willing to give back to you and your community).

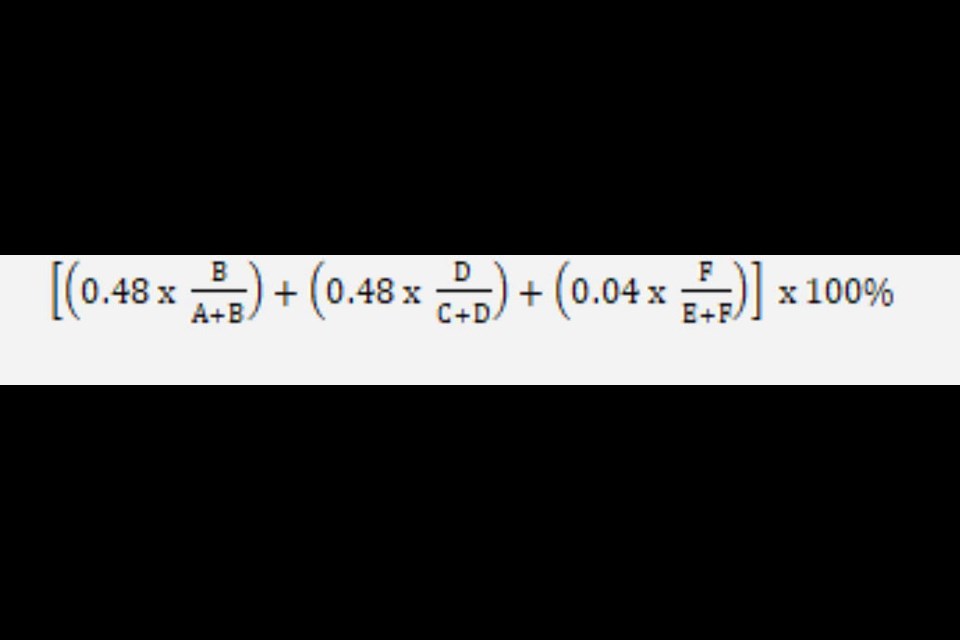

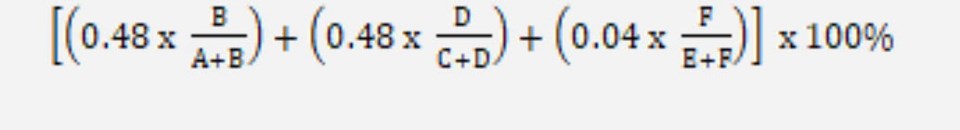

So how do we find this pesky but vital Revenue Index Factor? Lucky us — Inside the soon-to-be implemented framework, the provincial government has given us this easy formula to find it. We'll start with the Edmonton and Calgary example to make it easier to work with:

When you want cash for your town's new skating rink or stage at the community hall ... just apply this formula. Still want the money? Image from the Queen's Printer.

When you want cash for your town's new skating rink or stage at the community hall ... just apply this formula. Still want the money? Image from the Queen's Printer.So, what's G? Well G, we're glad you asked (a little infused humour to make this easy formula even more fun)!! G is the revenue index factor we just calculated. H is the available capital funding for the fiscal year one year prior to the applicable fiscal year.

And that's all you need to kn— Oh, wait. There's more. OK. So now that you have all these numbers and letters — and are now wondering if you really need that community hall stage lighting afterall — simply divide the result of I minus J by J, multiply that by .05 and then add one.

Did we lose you there? Thought so. OK, so I (which looks a bit like a J when it's included in formulas, but looks way more like the number 1, or even a lower case l, like the one that starts loopy...and is a truly baffling letter to put into such a complex formula) is the provincial revenue for the fiscal year 3 years prior to the applicable fiscal year adjusted, if applicable, and J is the same ... but for the fiscal year 4 years prior.

So there you have it. That's how much Edmonton or Calgary can expect to receive in provincial funding. Can Millwoods afford that new splash park? Dunno — check the formula. How convenient.

Now how about our little communities? Well that formula is much easier in the new plan. But it still requires the alphabet for some reason. For rural Albertan communities outside the two major cities, funds will be disbursed by knowing your Ps and Q's. Seriously.

P, says the government's proposed legislation, is the revenue index factor we calculated for the big cities above. Do that with local numbers and you get the index number. Multiply that by Q, otherwise known as the available capital funding for the fiscal year one year prior to the applicable fiscal year. Don't forget to round up or down to the nearest ten-thousandth, and then subtract the sum of R minus S and divide that by S. Multiply that total by 0.5 and add 1.

Try and keep up — R is obviously the provincial revenue for 3 years prior to the applicable tax year adjusted, and S is the same, but for the fiscal year 4 years prior. See simple.

So at this point you might want to ask me, the writer of this explanation if we can we afford that new community playground in Mallaig?

I'm not sure. I lost focus of what I was writing somewhere between C and G. And perhaps that's what the government is counting on ... that no one will be able to count using this formula, hold anyone a-countable, or count on the way things used to be.

Disclaimer *There is a hyper link in this story to the Queen's Printers page with the wording of the proposed Local Government Fiscal Framework Act. We ask you, the reader, to please use caution when opening the link as it contains more challenges and hurdles than giant rolling rocks, moving spike-walls, blow darts and snake pits.