Property owners in some Moose Lake subdivisions are facing significant property tax hikes in 2010 because of major hikes in their property assessment.

The hikes are being felt not only by MD of Bonnyville property owners, but also those in the summer villages of Pelican Narrows and Bonnyville Beach.

“I had a few calls and a few letters,” MD Ward 2 Coun. David Fox said early last week, adding that he expected they would continue to flow in.

As of last Tuesday, Fox said he had heard feedback on the 2010 tax shift from nine ratepayers — eight more than he had heard tax bill complaints from in his first two years in office.

What's causing the complaints are double and triple digit percentage increases in assessed values of some properties in the past few years, particularly those fronting onto Moose Lake or with lake views.

Even those that aren't right next to the lake have soared in assessed value. Just ask Urgel St. Pierre, an Edmonton resident with an undeveloped lot in the Ferbey subdivision on the south shore of Moose Lake.

St. Pierre's vacant, unserviced lot was assessed at only $25,020 in 2007.

That jumped to $60,380 in 2008, then to $78,490 in 2009 and $108,500 in 2010.

That amounts to a percentage increase of 333.65 per cent in only three years.

St. Pierre's tax bills haven't gone up quite as much — only 229.3 per cent during the same period. But it's still a bit of a shock to be paying $163.19 for a property in 2007 and then $537.33 of the same piece of unserviced land three years later.

“In any other area that I'm familiar with, nothing's gone up (333 per cent) in the past three years,” St. Pierre said last week.

He said his 1.24-acre lot is used to park a camper on occasionally, but isn't used much beyond that. Still, he doesn't want to sell it.

“I find it very unthinkable that it would have gone up that much,” he said.

Fox said he heard from one Moose Lake area property owner — a retired man in his eighties —who is looking at a 2010 tax bill hike of $958.

“That's a pretty hard one to swallow,” he said.

“Assessments have gone up over a hundred thousand dollars a lake lot. That's quite a bit of money,” Fox said. “So that's quite an increase in taxes.”

He said the assessment hike is tough on seniors who don't want to sell their retirement homes and aren't interested in their values going up.

“There's a lot of people, they're older people, on fixed incomes that aren't going to sell their piece of property,” Fox said. “So going up in value doesn't do them any good right now.”

All of the property in the MD and the two summer villages is assessed by Assessment Valuation Group Inc., a company headed by veteran assessor Victor Koluk. The company also assesses property in several other municipalities, including the Town of Bonnyville.

Koluk said the 2010 assessed values reflect an analysis of increased sales values for both vacant and improved lots in several lakeshore subdivisions around Moose Lake.

“It's the local market that's dragging this,” Koluk said, explaining that sales prices for properties that have sold around the lake continued to increase despite the slip in the economy in 2009.

Assessed values for properties in 2010 are based on a valuation date of June 30, 2009.

Vacant lakeshore lots have increased from about $200,000 to $300,000, Koluk said. In one case, a 1.19 acre vacant lot in North Shore Heights sold for $423,000.

Koluk said his company looks at actual selling prices, not asking prices for lots, so the numbers studied reflect the market values.

Sales in the area in the past year included six vacant lakeshore lots and eight similar lots with improvements, he said.

On average, lakeshore tax bills are up in the range of $500 in the Moose Lake area, he said.

Other lakeshore lots further away from Bonnyville and Cold Lake have increased considerably less or not at all, in some cases.

“Crane had increases, but not as significant,” Koluk said, while Muriel Lake lots generally didn't jump.

Assessment figures are audited by the provincial government, because it uses them to determine school tax requisitions from municipalities, Koluk noted.

Koluk said concerns about combined tax/assessment notices for lake area properties have come mostly from seniors who don't plan to sell their homes.

While a local government's assessor must follow provincial regulations on how properties are assessed, the Municipal Government Act provides municipalities with the flexibility to phase in tax increases when the assessed values of properties change significantly.

Section 347 (2) of the MGA reads: “A council may phase in a tax increase or decrease resulting from the preparation of any new assessment.”

Koluk said he doesn't encourage municipalities to use that provision of the MGA, adding that the practice of trying to compensate for assessment shifts isn't fair or equitable.

Some municipalities have tried to limit wild swings in tax bills.

The Town of Banff, for example, phased in tax increases and decreases for its non-residential property owners that resulted from significant shifts in assessed values about six years ago.

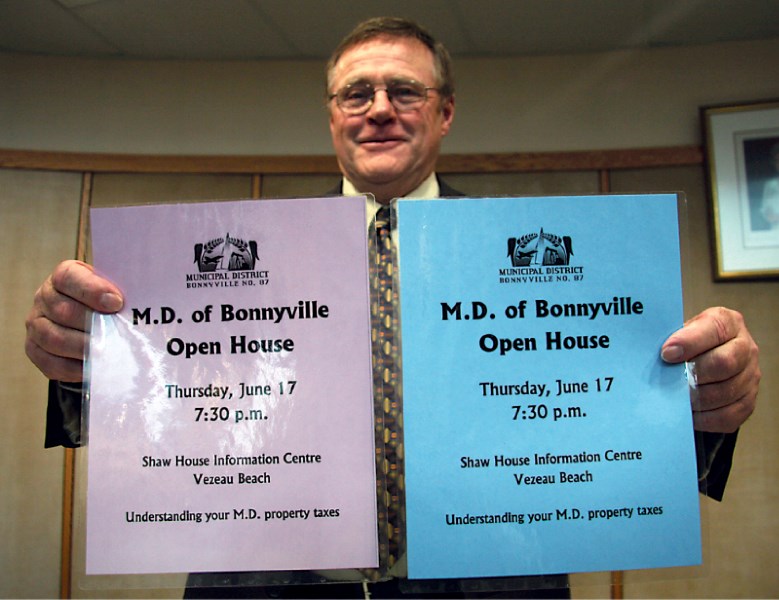

The MD plans to hold an information meeting on the issue at Shaw House at Vezeau Beach on Thursday evening starting at 7:30 p.m.

Assessment concerns can also be brought to Koluk and his staff in their office above the Royal Bank in Bonnyville. Assessment Valuation Group can be reached at 780-826-3589.

The office will be open from 10 a.m. to 8 p.m. Wednesday as well as during regular business hours Monday to Friday.