BONNYVILLE – The Town of Bonnyville gave third reading to the 2025 tax rate bylaw which will reflects an “average residential municipal tax dollar increase of two per cent and non-residential municipal tax increase of four per cent,” according to the Town of Bonnyville CAO Renee Stoyles.

Taxes will be due June 30.

The motion was carried unanimously and without further discussion from council, during the May 13 council meeting.

Stoyles explained that the residential tax rate for properties has increased by 0.35302 mills.

"[This is] due to several factors, including an increase to the Provincial School Requisition, a slight decrease in the Seniors Requisition, the two per cent municipal tax dollar increase, as well as a decrease in overall residential assessments. The overall Multi-Family Residential Tax Rate has increased by 0.09722 mills due to the same factors as listed above except there was a slight increase in multi-family assessments,” said Stoyles.

Stoyles further explained that the non-residential tax rate for properties has increased by 0.06042 mills.

The overall Tax Rate for Non-Residential Properties has increased by 0.06042 mills, due to the same factors as the residential tax rate, only there was a four per cent municipal tax increase rather than two per cent.

“[Overall], the tax rate increase is 3.41 per cent for Residential, 1.05 per cent for Multi-Family Residential and 0.38 per cent for Non-Residential,” said Stoyles.

According to the bylaw, estimated municipal expenditures for 2025 total $34 million.

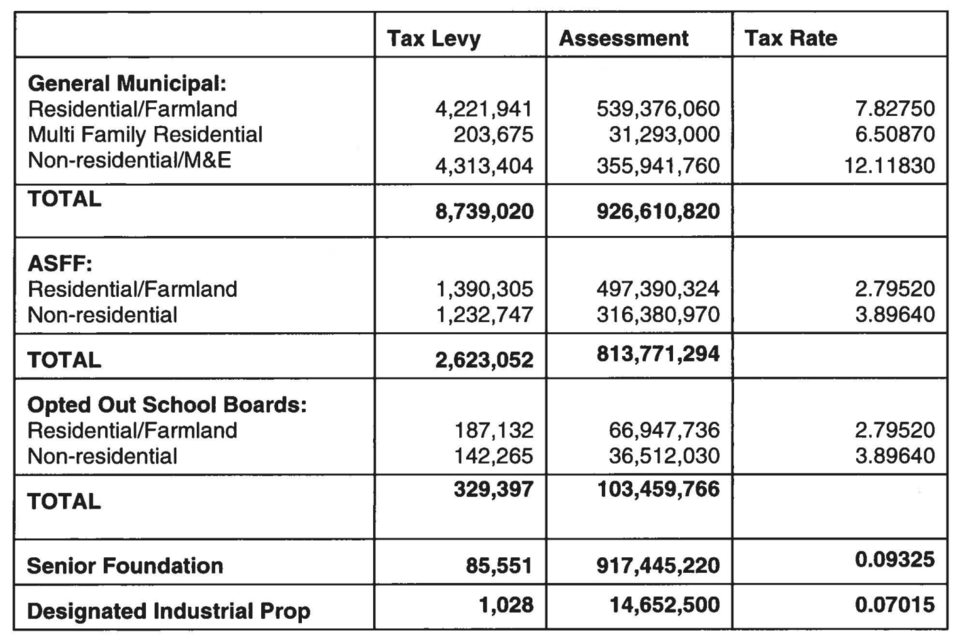

“The estimated municipal revenues and transfers from all sources other than taxation is estimated at $25.3 million and the balance of $8.7 million is to be raised by general municipal taxation,” states the bylaw.

For those seeking a detailed analysis of the impact of these tax rates, the Town of Bonnyville website has included supplemental information attached to the 5.b Bylaw No. 1601-25 – 2025 Rates of Taxation section of the May 13 council meeting agenda.

According to the Town of Bonnyville, assessment and property tax notices were mailed out on May 16.

Assessment concerns can be directed to Accurate Assessment Group. A Government of Alberta Assessment Review Board Complaint Form must be used to object to an assessment and must be done within 60 days of the Notice of Assessment.

The appeal period is May 26 - July 25.