Lac La Biche County councillors have unanimously agreed not to increase the municipal portion of the tax collection formula for 2022.

At their public meeting Tuesday morning, all seven of the nine council member present for the meeting voted in favour of keeping the urban and rural municipal mill rate for residential and non-residential properties the same as the previous two tax years.

“Lac La Biche County residents enjoy excellent municipal programs and services for one of the lowest residential tax rates in Alberta”

— Lac La Biche County Mayor Paul Reutov

The decision to hold the municipal tax rate was explained by councillors as a way to minimize already challenging economic times for residents who are seeing fuel, utility and grocery bills rise steeply.

"We do need to hold the taxes in 2022. Obviously, the fact that there are so many other increases that are affecting families," said Mayor Paul Reutov, at the same time cautioning that the tax rate may not remain static in future years. "We can't hold the line forever, but this will give residents a chance to catch their breath with all of the economics that are out of our control."

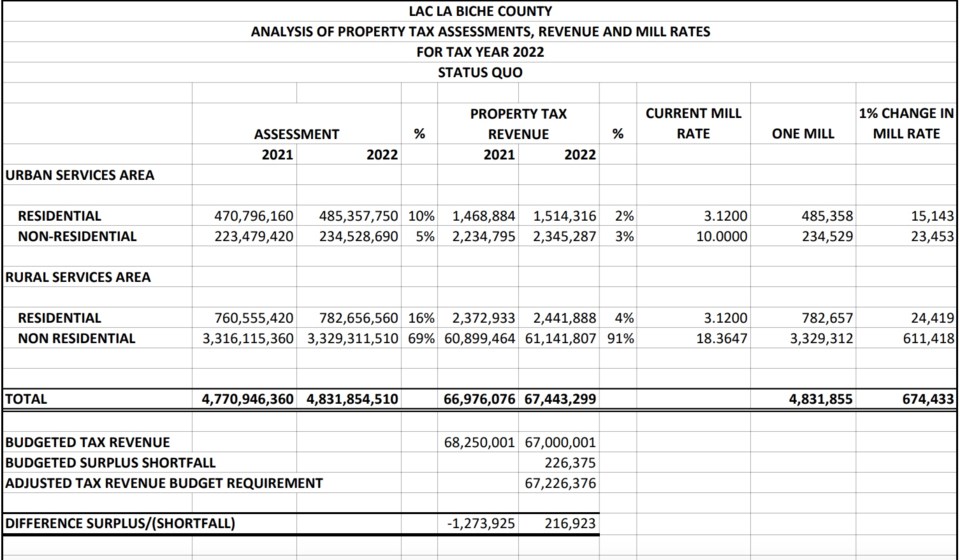

If council had increased the municipal rates by one per cent for residential and non-residential properties within the County, it would have generated an additional $674,000 in revenues. A two per cent increase would have generated more than $1.3 million in additional revenue.

Increases in other areas

While the municipal portion of the tax rates will stay the same for this tax year, councillors cautioned that some residents and commercial properties could still see increases to their overall taxes based on provincial increases to the education tax levy. The education levy could see increases of as much as four per cent over last year in some sectors of the community, while most residential owners and local businesses will see the provincial education levy increasing by about one-and-a-half per cent over last year. A slight increase — less than a tenth of a percent — is also expected in the provincial requisition for seniors housing. In addition to the provincial increases, assessment rates on the value of properties have seen an increase over the last year.

According to municipal records, property assessments used in the 2022 taxation formula, that were evaluated last summer, showed a significant rebound from the previous year — despite the hardships that were continuing as the COVID-19 pandemic continued.

The overall increase in assessment throughout Lac La Biche County for 2022 translates into about $50 million over last year, going from $4.77 billion to $4.83 billion. Most of that additional assessed value comes from increased values in the rural industrial sector.

Rebound in assessment

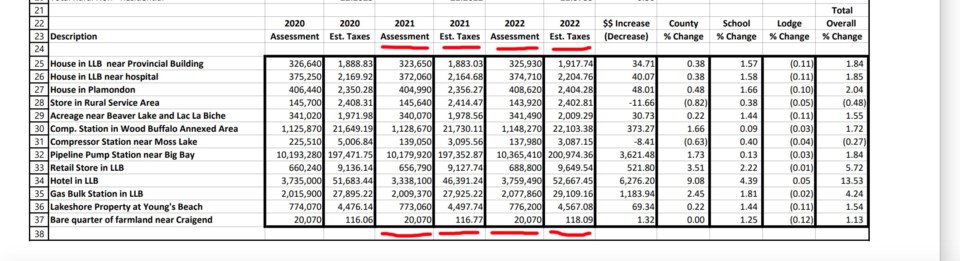

A comparative chart released by municipal administrators showed an average "retail store in LLB" that was assessed in 2020 at $660,240, dropping to a value of $656,790 in 2021, but increasing more than five per cent to an assessed value of $688,800 for the 2022 tax year. Similar increases in assessment for the current year were seen in residential properties. Another comparative scenario presented by municipal officials showed a "house in Plamondon" with an assessed value of $406,440 in 2020, going down to $404,490 in 2021, but rebounding for 2022 with an assessed value of $408,620. In that scenario, even with councillors holding the line on the municipal mill rate portion of the tax formula, the increased assessment will mean an increase of $40 over the year in taxes.

*Source: Lac La Biche County

"Most of them are going up, one or two per cent — some more, some less," highlighted Lac La Biche County acting CAO Dan Small.

This year's overall financial picture based on the 2022 tax bylaw is expected to generate $67. 44 million in tax revenue for Lac La Biche County, an increase from last year's $66.98 million.

“Lac La Biche County residents enjoy excellent municipal programs and services for one of the lowest residential tax rates in Alberta,” says Mayor Reutov. “Council and I felt that due to the challenges our residents have faced over the last couple of years, the recent increases in utilities, and the rising cost of living overall, it was important to not raise taxes. I want to encourage growth and investment in our communities, while helping families get back on their feet as the economy recovers.”

With tax notices ready to go out, the deadline for residents to pay their municipal taxes is June 30.