BONNVYILLE – What does the future of the Town of Bonnyville’s property market look like – that would be difficult to say, according to assessment specialist Bob Daudlin.

Year over year property assessments for residential, non-residential and industrial properties in the Town of Bonnyville have not conformed to trends seen by other municipalities.

As a matter of fact, Daudlin, an assessor with Accurate Assessment Group tasked with assessing lands and buildings within the town, told council on March 14 that he struggles to find any trend in the Town’s recent assessments.

While the town’s property market seems to operate as somewhat of an enigma, the 2022 assessments for the 2023 tax year show some silver linings with a few anomalies sprinkled in.

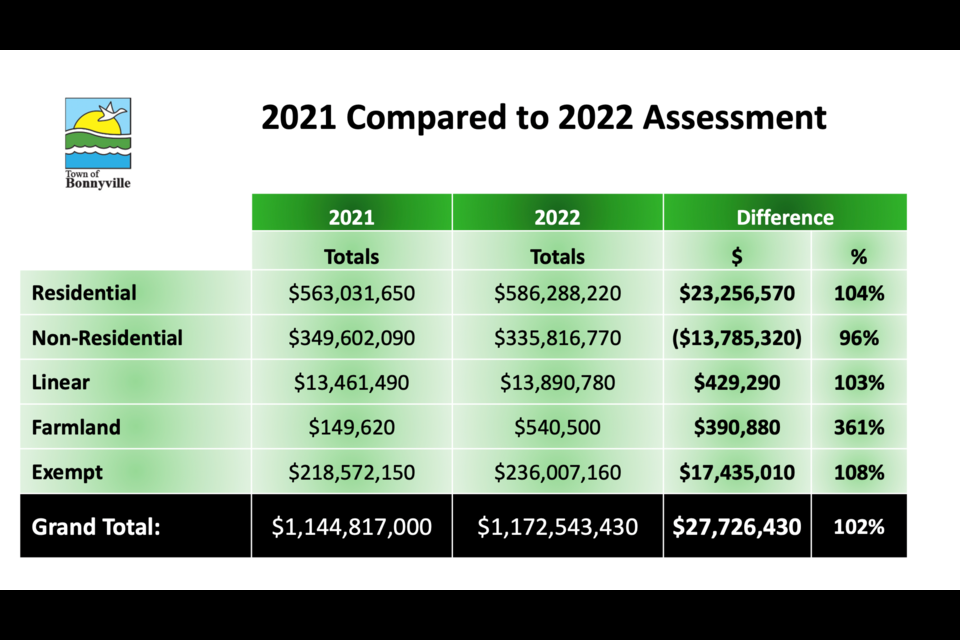

The Town’s total residential assessments came in at over $586 million for 2022, which was the first increase to residential assessments in Bonnyville since 2015. Residential assessment rose by approximately $23 million between the 2021 and 2022 assessment period, a four per cent increase.

Non-residential assessments in the town saw the opposite – a nearly four per cent drop. Compared to the previous year, all non-residential properties combined saw total assessments dip by $13.7 million, now sitting close to $336 million.

Linear assessments remained on par with the previous year, seeing the slightest increase to a total assessment value of nearly $14 million in 2022. Farmland assessments came in at $540,500, a negligible increase compared to 2021, according to Daudlin.

Exempt property assessments also made a jump to $236 million, an increase of about eight per cent. Properties that are exempt include anything from schools to hospitals, municipal owned property to churches and non-profits. Some provincially and federally owned properties are also exempt from municipal taxation, as well as greenhouses.

Roughly 84 per cent of properties in the municipality saw a one to 10 per cent increase in their taxable assessment.

Furthermore, Daudlin noted that 86 per cent of the taxable properties in town changed by less than $25,000 in assessment value.

“Even though there was somewhat of a decrease in certain sectors, most of the properties aren't changing a great deal,” he added.

Within the town there are four classes of assessment. There is residential, which makes up about 50 per cent of the total assessment base in town. Non-residential, which includes commercial, industrial sectors, highway commercial, downtown commercial, and the industrial park, makes up about 20 per cent of the municipality’s assessments.

“Residential assessment has been on a steady decline over the last five years except for this year, we actually started to bounce back a little bit,” said Daudlin.

“Non-residential assessment has been on a steady decline, [but] last year it was showing some promise in where the market was going, but this year meaning the 2022 assessment year, there were some sales that actually indicated a certain sector of non-residential had actually dropped.”

Daudlin pointed out that the change in assessment did not mean that market activity was necessarily decreasing, but rather the sales of non-residential properties within the year indicated that assessments had to be readjusted to meet what is conveyed as market value.

“Turbulent – that's the word that came with Bonnyville because it's a combination of economic times and then the COVID pandemic, it was just all over the place. Last year, we had residential assessment going down in market value, but the non-residential went up... It's just very difficult to get a year over your understanding,” acknowledged Daudlin, speaking to council.

Negative and positive growth

In a very unusual twist, the town’s residential assessment base shrunk.

Daudlin stated that while it doesn’t happen often, the town saw negative growth in its residential assessment base. “What transpired in the Town of Bonnyville is that we had many demolitions this year. Demolitions of homes due to whatever the case was... fire being one of them.”

The total “lost assessment” accounted for roughly $1.1 million in the residential category.

Daudlin shared that inflation and market change indicated a 4.3 per cent increase on average for residential property value.

"Not every property increased by 4.3 per cent in town. But on average, that's what happened to residential assessment.”

New construction growth for non-residential property saw a $1 million gain in assessment, about 0.3 per cent. This growth was attributed to the new Inland Steel facility that opened in Bonnyville.

However, non-residential saw an overall 4.2 per cent deflation in purchase price based on open market sales during the 2022 assessment year.

As Daudlin wrapped up his presentation, he noted that Accurate Assessment group will be working with the town’s administration to mail out property tax assessments in the next month or two.

If after all information is gathered and reviewed, and a ratepayer is unsatisfied with their assessment, a formal assessment complaint can be filed, he added.

Mayor Elisa Brosseau followed the presentation adding, “Last year, when you were here you told us we lagged behind other municipalities to get back to, shall we say a normal state, after COVID and now you can't find a trend and we're turbulent. So hopefully next year, you come back and it's a little bit more on the positive side.”

In the coming weeks, council will have to determine the mill rates for 2023 tax year. Once mill rates are approved, property owners will have the assessed value of their property multiplied by the set mill rate, which will determine their 2023 property taxes.